Recent Features

TESTIMONY

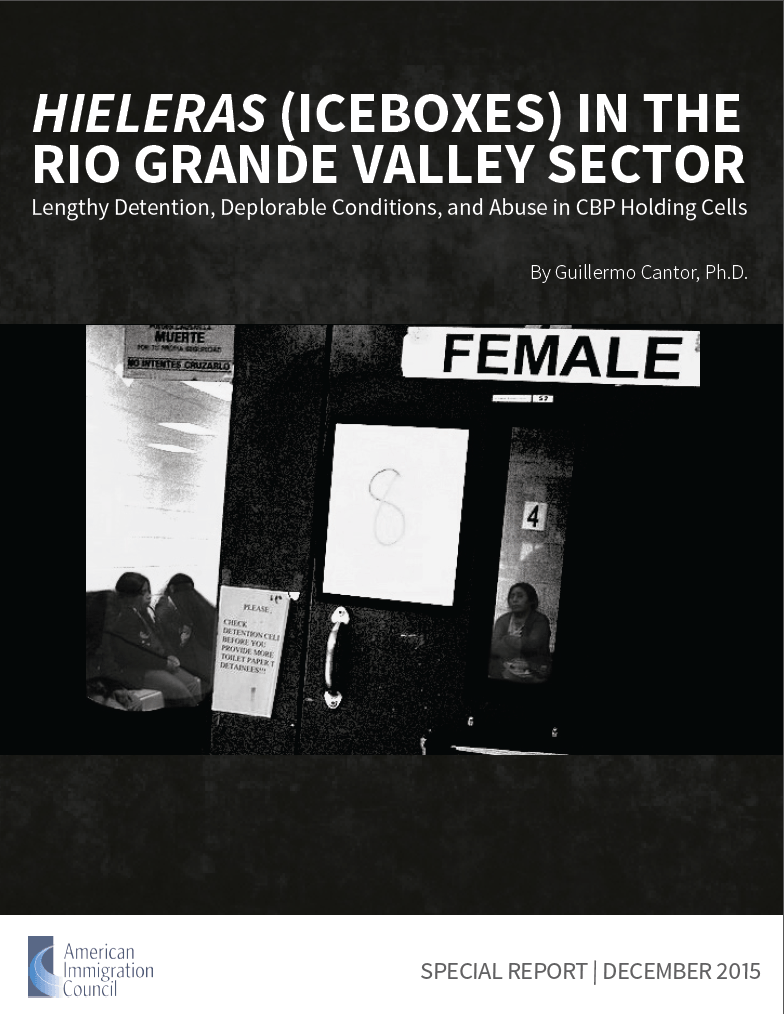

The reality at the U.S. southern border is complicated. Dive into the role and authority of the executive branch and immigration enforcement agencies.

FACT SHEET

For generations, the United States has seen periodic cycles of migration. The arrival of high numbers of asylum seekers is a humanitarian protection management challenge, not a security challenge.